Home

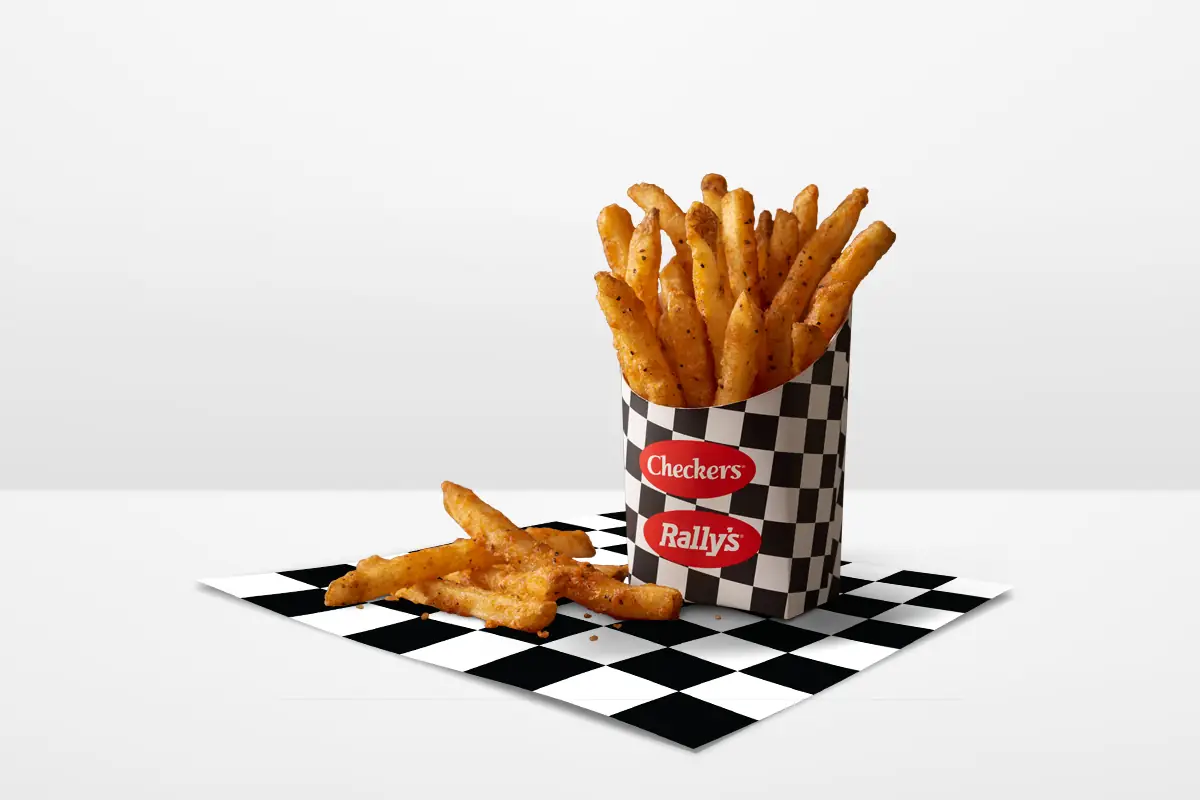

Product appearance and ingredients may vary slightly by market. ©2024 Checkers Drive-In Restaurants, Inc. 20240128

Featured Deal

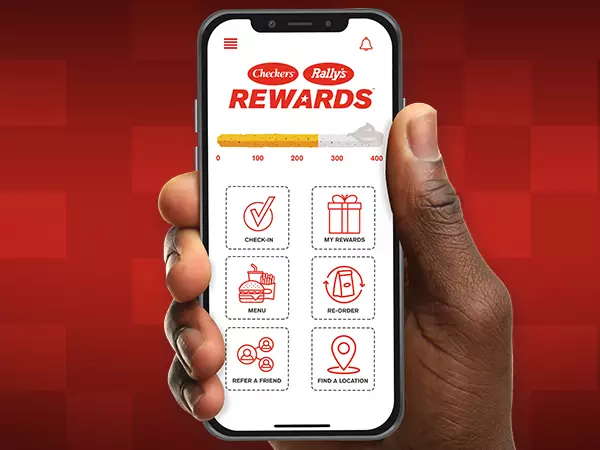

GET 250 POINTS AFTER FIRST PURCHASE!

(MORE THAN HALFWAY TO YOUR FIRST $5 REWARD*)

JOIN REWARDS TODAY

*Follow instructions in app to earn points when ordering. Restrictions Apply. See Rewards Program Terms for details at https://www.checkers.com/rewards-terms/. Offer may vary by location

Learn More

Fast Foodies

Know The

Deal

View Specials